Summary

- Diesel powered vehicles have steadily declined in sales over the past 1.5 decades

- Exacerbated by VW’s Dieselgate scandal and the rise of EVs

- The only sector that has maintained or even grown is heavy duty vehicles

- Even in heavy duty, companies are working to make EV and hydrogen fuel cell technologies applicable to displace diesel

- Looking at market trends, we believe that the only way to save diesel is to convert completely to bio-diesel

In recent years, the automotive industry has witnessed a notable shift in consumer preferences and market dynamics, particularly when it comes to diesel-powered vehicles. Due partly to the scandal that was VW’s “dieselgate,” as well as the rise of EV’s as a more economical choice, the decline in sales of diesel engine vehicles has been a prominent trend.

In fact, it has become such an issues that some manufacturers, such as Porsche, have stopped producing diesel vehicles outright. In this article, we delve into the key reasons behind the diminishing appeal of diesel engines and the market data associated with the decline.

The Changing Market

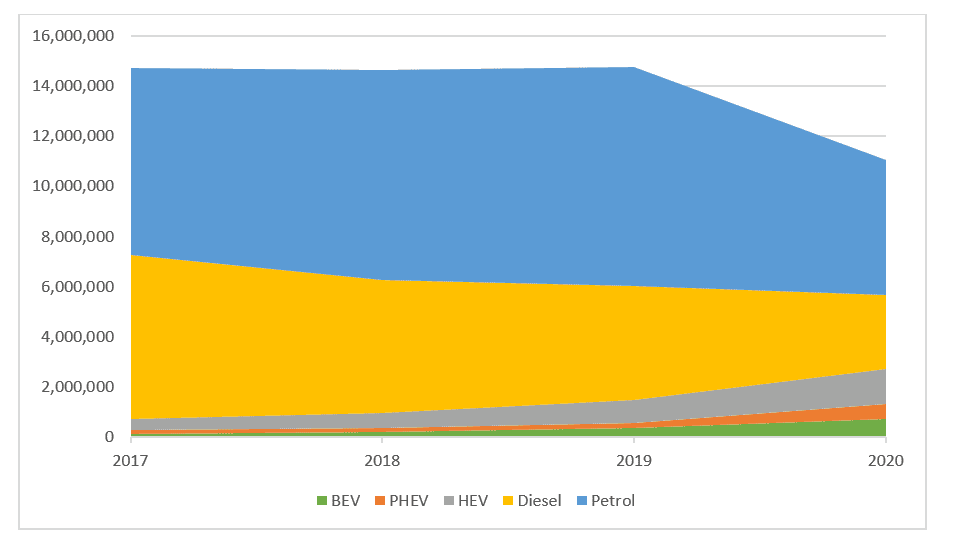

To comprehend the decline in diesel vehicle sales, hard data is needed compared to other types of power to understand just what is causing it. According to a study done by Bellona.org between 2017 and 2020, focusing on Europe, the stark truth is that hybrid electric (HEV), plug-in hybrid (PHEV) and full battery electric (BEV) vehicles have gained market traction at nearly the same rate as diesel engines have declined.

Before 2017, diesel vehicles were already in a state of decline, mostly due to VW’s admission of falsifying emissions in the Dieselgate scandal. It was in this period, however, that many manufacturers also signed on to the unofficial “Green Promise” of making their model lineups completely or mostly EV’s by 2040, many promising to do so by 2030. Even America’s favorite vehicle, the pickup truck, isn’t safe, with an almost across the board decline in sales YOY 2022 to 2023, especially with diesel models.

Environmental Concerns Take Center Stage

One of the primary factors contributing to the decline in diesel vehicle sales is the growing emphasis on environmental sustainability. Diesel engines have long been associated with higher emissions of nitrogen oxides (NOx) and particulate matter, leading to increased scrutiny and stricter emission regulations worldwide. This has been exacerbated by the ever tighter CARB and Euro emissions standards, which have struck particularly hard in an area many don’t think about.

According to Eurekalert, the newsletter for the American Association for the Advancement of Science, farm vehicles, tractors, and heavy trucks (semi trailers, heavy goods vehicles, et al), all of which run on diesel, are some of the worst polluters. Due to exceptions in laws and standards due to how vital farming is for food and tractor trailers for the transportation of goods and foods, when those exceptions expire, it has been very expensive to either upgrade or outright replace farm vehicles.

Evolving Regulatory Landscape

As much as they can sometimes hold back progress, it has been governments and regulatory bodies around the world that have been instrumental in investment into cleaner vehicle technologies. The European Union’s stringent emission standards, known as Euro 7 norms, have set the bar high for vehicle manufacturers. The transition towards electric and hybrid vehicles has been incentivized through subsidies and tax breaks, further contributing to the decline in diesel vehicle sales.

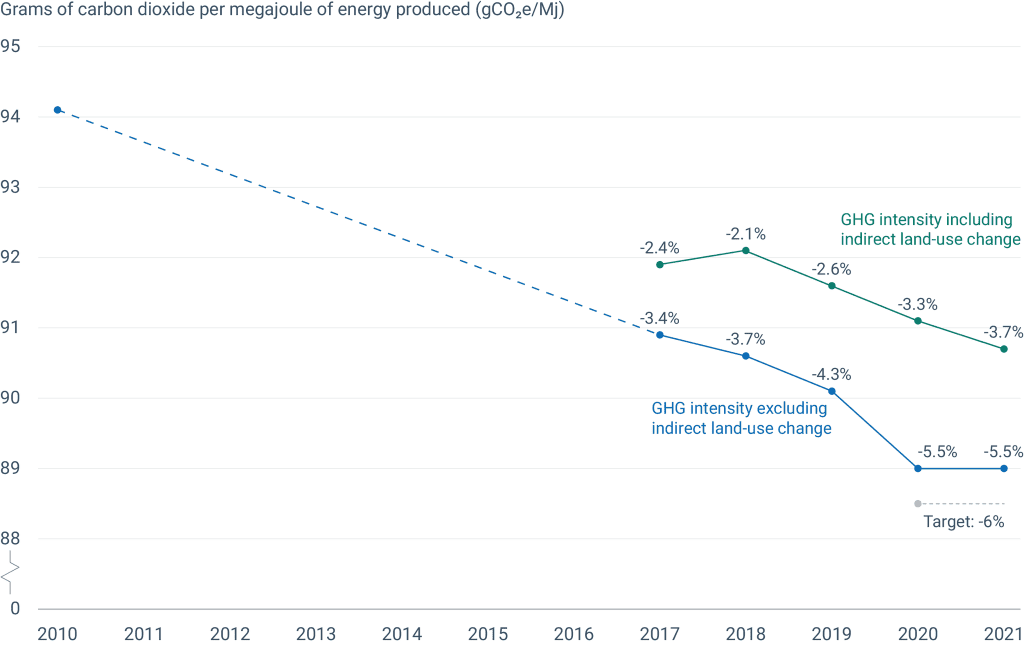

According to a report by the European Environment Agency, the share of diesel cars in new registrations in the European Union fell from 50% in 2011 to 27% in 2020. Despite this, the target reduction in greenhouse gas emissions from road-based vehicles has fallen short of predicted levels, with a target of -6% emissions from 2010 levels, and reaching only -5.5%.

Basically, even with ever stricter emissions regulations, even EV cars pollute. The materials needed for the batteries in those vehicles require mining and extracting the pure minerals, such as nickel, in a less-than-environmentally-ideal fashion. As well, unless specifically stated as using renewable energy, a lot of charging stations for those vehicles are powered by non-renewable power grids. Regulations are coming to require charging networks to use only renewable energy sources, but that likely won’t be put into effect until at least 2026, if not later.

Rise of Electric and Hybrid Alternatives

As alluded to many times so far, the rise of electric and hybrid vehicles has undoubtedly played a pivotal role in the decline of diesel engine sales. Advancements in battery technology, coupled with increased charging infrastructure, have made electric vehicles (EVs) more appealing to consumers, especially as ranges start to approach those of a petrol powered vehicle. With the rapid release of many EVs in 2022 through 2023 by many manufacturers, EVs and petrol vehicles are getting within 15% of each other in terms of price parity.

The success of Tesla, especially with the Model 3, and the increased investment by traditional automakers in electric mobility signify a broader industry trend, with many of those advancements also benefiting PHEV and HEV vehicles in their battery tech . Governments are also incentivizing the adoption of EVs through subsidies and infrastructure development, contributing to the declining market share of diesel vehicles.

As the decline in diesel engine vehicle sales up to 2023 has shown, a gigantic mess of factors has shaped this trend. Environmental concerns, evolving regulatory landscapes, the rise of electric alternatives, changing consumer perceptions, and economic considerations have all played crucial roles. In fact, through our research, we believe that fossil-fuel based diesel is on its last legs, and if the industry truly wants to save diesel as a whole, there must a be a wholesale shift and heavy investment into bio-diesel.

If that shift to bio-diesel happens, there is a chance for diesel to regain a little bit of a foothold. As Honda and GM both invest heavily into hydrogen fuel cell technology, with the hopes of powering heavy duty vehicles with them, it is not expected to be implemented in any considerable way until 2030. In that timeframe, according to the Imarc Group, diesel sales, particularly in heavy industry and not so much in “normal” vehicles, is expected to gain 3.2% market share, or increasing from $229.0 billion in 2023 to a forecast $308 billion share in 2032.

If they can make that increase with a concurrent investment into bio-diesel, there still may be a place after 2030 for the highest fuel-to-torque ratio engines yet…